Our expertise in the emerging space commerce sector is leveraging entrepreneurs and start-ups to find their profitable place in space.

Our advisory services are one-on-one relationships designed to steer emerging space related companies through phases such as:

‣ Capital Raising; strategies, representation, business modelling, shareholder segmentation, crowdfunding.

‣ Business Development and Entry to Market; approaches for B2C, B2B, NGO, GOV.

‣ Scaling-up; from tech to user base.

‣ Mergers and Acquisitions; options and positioning.

‣ Exits; for early investors.

and for some, ultimately an IPO; on technology focussed exchanges, possible blockchain.

Additionaly, SVI also offers Marketing, Business Development, and Sales for Space Startups.

More about Simon Drake, also on LinkedIn.

Space Ventures Investors may invest in your company but also represents independent private investors and large investors who want to invest in space companies.

Private Investors are aware of the high-risk nature of start-ups and space commerce, and some prefer to invest in different areas, like satellites, space tourism, even space resources.

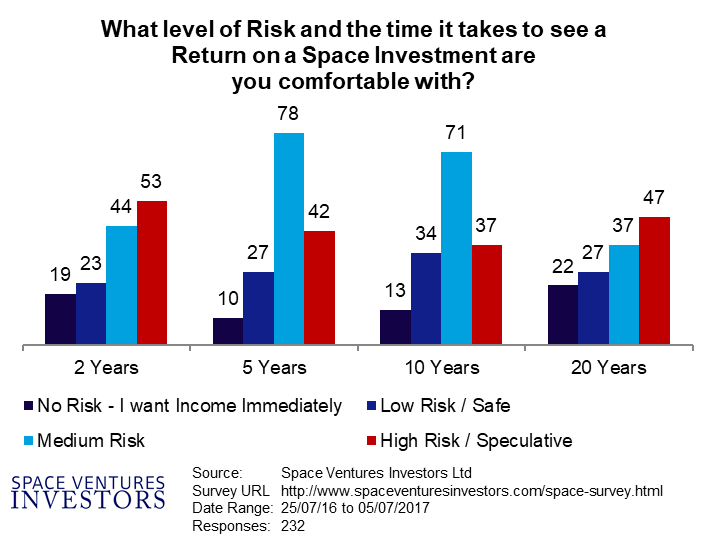

On the right hand side is a sample from a

survey about investing in space.

The key take-away is the risk tolerance of most space investors is high, meaning that they understand the nature of the investment. This therefore shapes the mentality of space start-ups and space companies searching for new investors - Space 2.0 is in no way like a Dot Com / Social Media tech boom. Investors are more patient and educated.

Large investors are more strategically focussed, risk averse, yet able to instigate game-changing space commerce business models by the weight of their investment and in some cases, their branding; lead investors often pave the way for follow-on investors.

SVIís growing network of international space investors have diverse risk profiles and tolerance, interests, and financial expectations.

Get in contact to find out what space investors we can match to your space commerce business.

Space Ventures Investors will need to know your Business Plan, Team, 12 month and 5 years plans, plus Merger and Acquisition options.

Most importantly, how can your business evolve to take advantage of a rapidly changing space sector, be it commercial activity, government mandated changes e.g. (think of the inevitable world governments organising a solution to space debris) and unpredictable events and opportunities.

SVI may introduce investors to your start-up Ė We will work with you through this process, including setting up a non-exclusive, fee-based mandate, for raising capital.

If you are based in Europe, experience from

Catapult in the UK and the

ESA BICs located all around Europe, is helpful.

Space Ventures Investors is looking to work with previously funded and yet to be funded space companies who have ambitious long-term business plans and a mature investor base.

The current goal of SVI is to focus on space companies that are developers of technological solutions that address realistic commercial endeavours and fit into our

Strategic Space Value Chain.

SVI is also interested in joint ventures and modelling various space commerce business plans and opportunities; the cost-intensive scale of mass-market space ventures requires concentrated pre-planning and research. This is also covered in SVIís

Due Diligence service.

Astute investors who have a fusion of strategic and technical focus on different space industry verticals, will value shares of varying classes in established and growing space companies, based on their own perception from intersecting space market cycles.

Space Ventures Investors will also offer its own valuation, based on ongoing internal

space industry research.

If you are a founding investor, management, ordinary shareholders, SVI can facilitate as a unique secondary market for space companies.

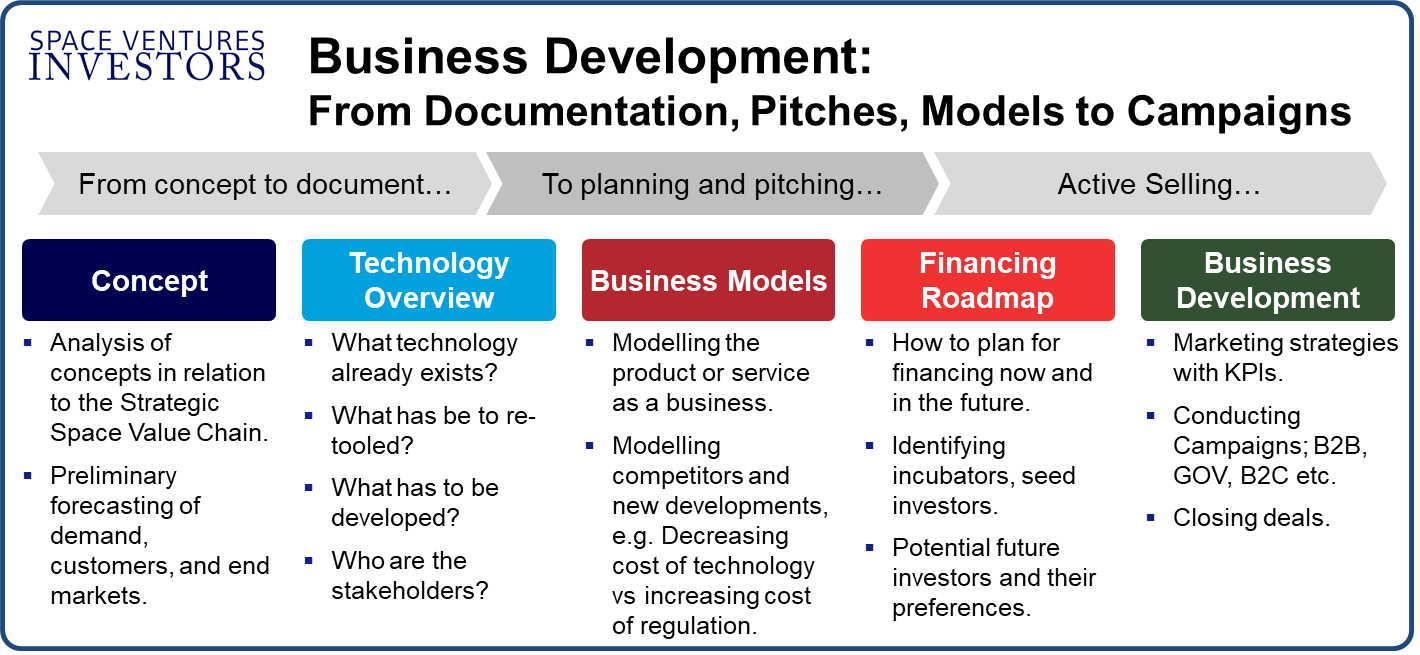

Concepts

‣ Analysis of concepts in relation to the Strategic Space Value Chain.

‣ Preliminary forecasting of demand, customers, and end markets.

‣ Strategic decision making, e.g. is the concept worth scaling-up or just a niche consultant?

Technology Overview

‣ What technology already exists, what has be to re-tooled, what has to be developed, and who are the stakeholders involved?

‣ We can provide a technology roadmap for growing a new business in emerging space commerce sectors.

Business Models

‣ We are active in modelling space products or services, from earth observation software right through to orbiting infrastrucutre projects.

‣ We also model competitors and new developments, like the decreasing cost of technology vs increasing cost of regulation.

Financing Roadmap

‣ We can assist in the planing for financing now and in the future, identifying incubators and seed investors.

‣ and lastly the potential future investors (e.g. Series A, B) and their preferences.

‣ We can also model how much equity to trade for investment.

Business Development

‣ Market research: Further defining and refining the commercial space product or service in relation to international competitors.

‣ Marketing strategies: Setting and refining Key Performance Indicators and Milestones.

‣ Conducting Campaigns; B2B, GOV, B2C etc.

‣ Specific Business Development: target the right customers with the right approach.

‣ Closing deals.